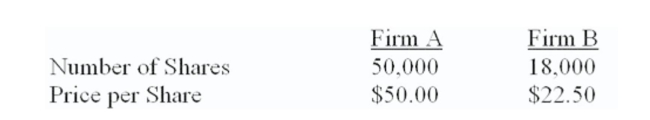

Suppose you have the following information concerning an acquiring firm (A) and a target firm (B) . Neither firm has any debt. The incremental value of the acquisition is estimated to be $250,000.

Firm B is willing to be acquired for $540,000 worth of Firm A's stock.  What is the value of Firm B to A in this case?

What is the value of Firm B to A in this case?

Definitions:

Budget Allocation

The process of distributing available financial resources among different departments, projects, or sectors within an organization or government.

Utility Maximized

The point at which a consumer achieves the highest level of satisfaction possible, given their budget constraints and the prices of goods and services.

Price of Goods

The amount of money required to purchase a particular good or service in a market.

Revealed Preference Analysis

An economic theory assuming that the choices made by individuals reveal their preferences and the value they assign to those choices, used primarily in consumer behavior analysis.

Q62: Pluto, Inc. is trying to decide whether

Q131: Provide a definition of a poison pill.

Q132: An interest rate swap is often used

Q158: Suppose you have the following information concerning

Q196: A plot showing how the value of

Q205: The leasing of automobiles by consumers has

Q218: Provide a definition of a joint venture.

Q223: You expect to deliver 80,000 bushels of

Q288: Firm B is willing to be acquired

Q295: Firm A is being acquired by Firm