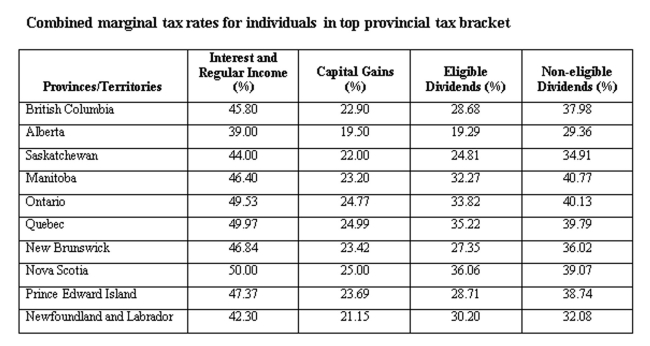

Calculate the tax difference between a British Columbia resident and a Quebec resident both having $20,000 in capital gains and $10,000 in eligible dividends.

Definitions:

Crime Drop

Refers to a significant reduction in the rate of crime within a specific geographical area or over a period of time.

Prison Boom

The rapid expansion of the prison population, mainly in the United States, starting in the late 20th century, due to changes in law and policy.

Neoliberalism

An economic and political ideology that favors free-market capitalism, deregulation, and reduction in government spending on social services, criticized for exacerbating inequality and environmental degradation.

Social Organization

A structure that governs how people or groups interact and function within a society, determining social roles, rules, and relationships.

Q7: Given the tax rates below, what is

Q34: Suppose you have the 2015 statement of

Q78: A current asset is:<br>A) An item currently

Q125: Your supplier grants you credit terms of

Q145: Exclusive, Inc. deals strictly with two customers.

Q189: A British Columbia resident earned $40,000 in

Q240: Under credit terms of 2/10, net 25,

Q249: Suppose a firm has a negative UCC

Q262: Burke Corporation is investigating a lockbox system

Q335: Your current sales consist of 25 units