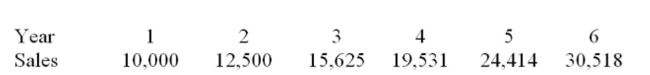

A project requires an initial fixed asset investment of $600,000, which will be depreciated straight- line to zero over the six-year life of the project. The pre-tax salvage value of the fixed assets at the

End of the project is estimated to be $50,001. Projected sales volume for each year of the project is

Shown below. The sale price is $50 per unit for the first three years, and $45 per unit for years 4

Through 1. A $30,000 initial investment in net working capital is required, with additional

Investments equal to 7.5% of annual sales for each year of the project. Variable costs are $35 per

Unit, and fixed costs are $50,000 per year. The firm has a tax rate of 34% and a required return on

Investment of 12%.  What is the operating cash flow during year 5 of the project?

What is the operating cash flow during year 5 of the project?

Definitions:

Income Statement

A financial statement that shows a company's revenues, expenses, and profits or losses over a specific period, providing insights into its operational efficiency.

Retail Business

A business type that sells goods or services directly to end consumers.

Gross Profit

The difference between sales revenue and the cost of goods sold, representing the core profitability of a company's products or services before deducting operating expenses.

Inventory Included

This refers to all items of merchandise, raw materials, work-in-progress, and finished goods that a company holds for the purpose of sale or production.

Q48: A project requires an initial fixed asset

Q111: Conducting scenario analysis helps managers see the:<br>A)

Q113: Assume that you graph the changes in

Q119: Capital structure refers to:<br>A) The amount of

Q178: The Interstate Hotel is considering building a

Q195: You are working on a bid to

Q226: Which of the following is an advantage

Q251: Which of the following is the best

Q287: The correct formula for computing the operating

Q318: Describe how the inclusion of a strategic