Trish earned $1,734.90 during the most recent semimonthly pay period. She is married and has 3 withholding allowances and has no pre-tax deductions. Based on the following table, how much should be withheld from her gross pay for Federal income tax?

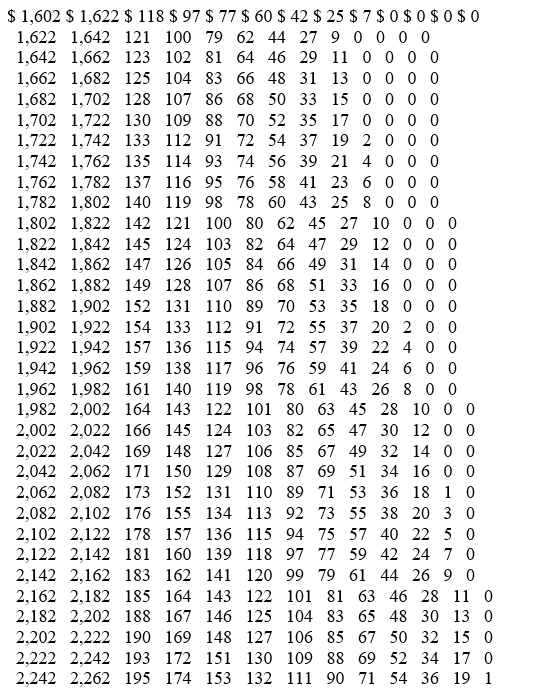

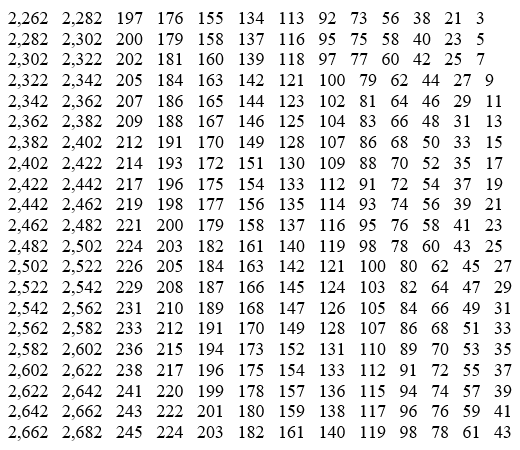

Wage Bracket Method Tables for Income Tax Withholding

MARRIED Persons-SEMIMONTHLY Payroll Period

(For Wages Paid through December 2019)

And the wages are And the number of withholding allowances claimed is-

At least But lessthan 0 1 2 3The amount of income tax to be withheld is-4 5 6 7 8 9 10

Definitions:

Long-run Equilibrium

A state in an economy or market where all factors of production are fully employed, and supply equals demand, resulting in stable prices and output.

Competitive Price-searcher Market

A market where firms set their own prices due to product differentiation and search costs but still face competition from other firms.

Competitive Price-searcher

A market condition where firms set their prices based on the search and competition among them, yet they have some control over their prices because their products are differentiated.

Marginal Cost

Marginal cost is the additional cost incurred in the production of one more unit of a good or service.

Q6: In what ways do service supply chains

Q15: What is meant by a complementary product

Q16: A company is able to implement one

Q23: What is the effect of payroll-related legislation

Q30: Which of the following statements is/are true

Q38: Which of the following federal withholding allowance

Q56: Agency costs are:<br>A) The total dividends paid

Q57: Luis Billiot is an employee of Plato

Q75: How do chartered banks generate income?

Q122: The board of directors has the power