Andie earned $680.20 during the most recent weekly pay period. She is single with 3 withholding allowances and needs to decide between contributing 2.5% and $25 to her 401(k) plan. If she chooses the method that results in the lowest taxable income, how much will be withheld for Federal income tax (based on

The following table) ?

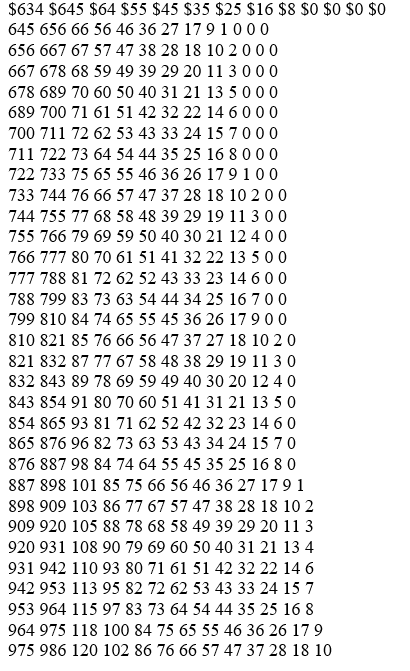

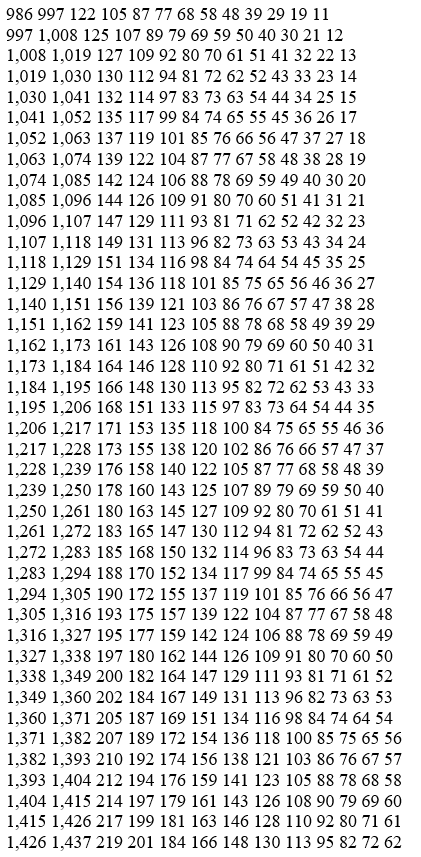

Wage Bracket Method Tables for Income Tax Withholding

SINGLE Persons-WEEKLY Payroll Period

(For Wages Paid through December 2019)

And the wages are And the number of withholding allowances claimed is-

At least But lessthan 0 1 2 3 4 5 6 7 8 9 10

The amount of income tax to be withheld is-

Definitions:

Rhetoric

The art of effective or persuasive speaking or writing, especially the use of figures of speech and other compositional techniques.

Equal Freedom

The principle that all individuals should have the same rights and opportunities to pursue their freedoms, without discrimination or unjust restrictions.

Blacks

A term historically and currently used to refer to individuals of Sub-Saharan African descent.

National Life

The characteristics, values, and societal structures that define the existence and collective identity of a nation.

Q8: What makes service supply chains more complex

Q11: Briefly define routine items and bottleneck items

Q27: Besides containing the supporting data for periodic

Q45: The use of paycards as a means

Q47: Which of the following is/are purpose(s) of

Q72: Which of the following is NOT considered

Q180: Working capital management is concerned with which

Q204: One purpose of identifying all of the

Q219: Tasks related to tax management, cost accounting,

Q247: Corporate social responsibility (CSR) is also referred