Trish earned $1,734.90 during the most recent semimonthly pay period. She is married and has 3 withholding allowances and has no pre-tax deductions. Based on the following table, how much should be withheld from her gross pay for Federal income tax?

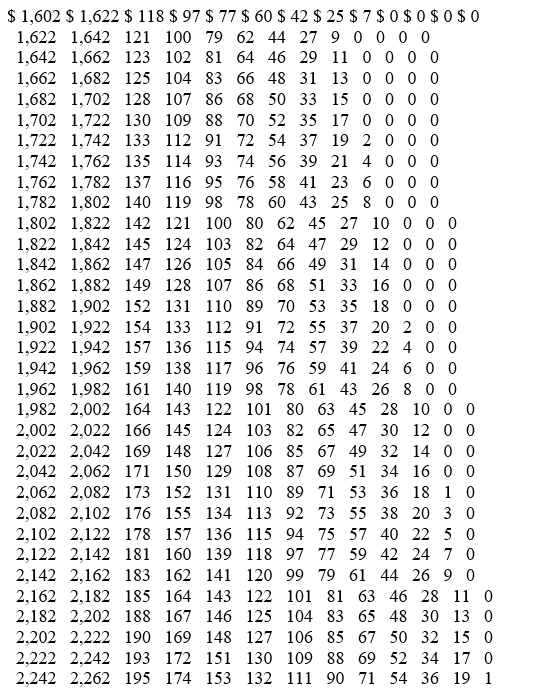

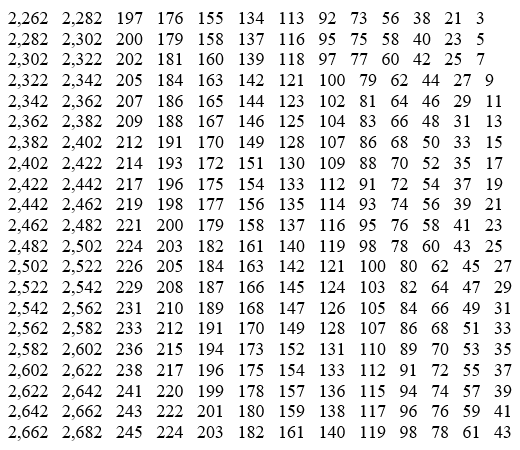

Wage Bracket Method Tables for Income Tax Withholding

MARRIED Persons-SEMIMONTHLY Payroll Period

(For Wages Paid through December 2019)

And the wages are And the number of withholding allowances claimed is-

At least But lessthan 0 1 2 3The amount of income tax to be withheld is-4 5 6 7 8 9 10

Definitions:

Return on Total Assets

Return on total assets (ROTA) is a financial metric that measures a company's profitability in relation to its total assets, indicating how efficiently a company uses its assets to generate profit.

Controlling Influence

The power to direct the financial and operating policies of another entity so as to obtain benefits from its activities.

Investee

A company or entity in which an investor holds a minority ownership, typically less than 50%.

Voting Stock

Shares that give the shareholder voting rights in a company's decisions.

Q12: Brittany is a full-time college student and

Q13: The purpose of payroll legislation is to:<br>A)

Q22: Zipperle Company has the following payroll information

Q23: What is the major difference between basic

Q27: Mac is a cook at a local

Q28: During his first month of employment, Alix

Q68: Salaried employees may be classified as nonexempt.

Q69: What is the difference between a defined

Q72: Which of the following is NOT considered

Q83: Which of the following is always true