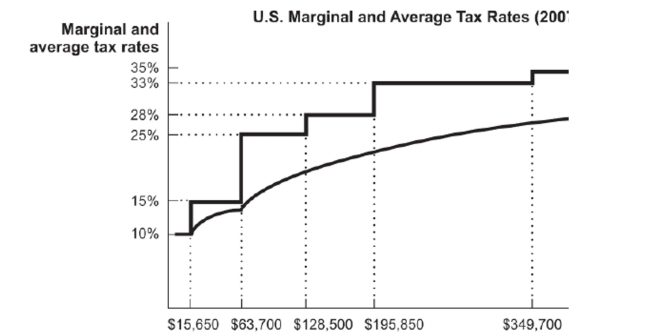

Figure: U.S. Marginal and Average Tax Rates  Reference: Ref 17-1 (Figure: U.S. Marginal and Average Tax Rates) Using the figure, assume your annual income is $15,000, that you have a deduction of $1,800 for moving expenses, and that you claim four exemptions of $3,300: one for yourself and one for each of your three children. How much taxes are you expected to pay?

Reference: Ref 17-1 (Figure: U.S. Marginal and Average Tax Rates) Using the figure, assume your annual income is $15,000, that you have a deduction of $1,800 for moving expenses, and that you claim four exemptions of $3,300: one for yourself and one for each of your three children. How much taxes are you expected to pay?

A. $132 B. $0 C. $138 D. $120

Definitions:

Wealth

Anything that has value because it produces income or could produce income.

Smokestack Industries

Sectors typically characterized by heavy manufacturing and industrial activity, often associated with high levels of pollution and traditionally rooted in the manufacturing era.

Exodus

The mass departure of people, often from a country or region, due to various reasons such as war, disaster, or persecution.

Welfare Dependency

describes a situation where individuals or families continually rely on government benefits for their basic needs over an extended period, often leading to a cycle of poverty.

Q35: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3375/.jpg" alt=" Reference:

Q50: The Medicaid program offers<br>A) health care benefits

Q52: Figure: Slave Redemption and Elasticity <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3375/.jpg"

Q59: Higher interest rates, a stable government, and

Q79: A transmission mechanism<br>A) mitigates shocks by spreading

Q82: A government can finance a budget deficit

Q101: This table shows data on taxes paid

Q103: Disinflation is engineered through monetary expansions.

Q125: The monetary base is equal to currency

Q135: Assume a product has an inelastic demand