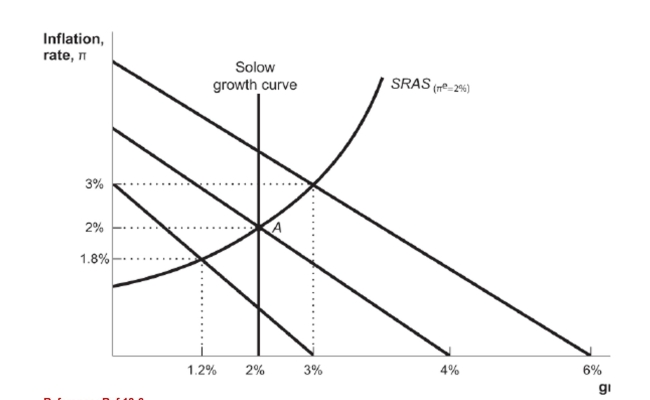

Figure: Three Dynamic AD Curves  Reference: Ref 13-6 (Figure: Three Dynamic AD Curves) Beginning at Point A in the figure, what is the short-run growth rate in this economy after a negative money shock?

Reference: Ref 13-6 (Figure: Three Dynamic AD Curves) Beginning at Point A in the figure, what is the short-run growth rate in this economy after a negative money shock?

Definitions:

Expected Rate

The rate of return that an investor anticipates earning on an investment without taking into account inflation or other factors that could affect the actual yield.

Liquidity Spreads

The difference in yield or cost between liquid (easily convertible to cash) assets and illiquid assets, often indicative of the liquidity premium required by investors.

Security A

A generic term used to represent a particular stock or financial instrument in theoretical examples.

Beta

A measure of a stock's volatility in relation to the overall market; a beta greater than 1 indicates higher volatility, and less than 1 indicates lower volatility.

Q7: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3375/.jpg" alt=" Reference: Ref 12-4

Q11: What factors cause dynamic aggregate demand to

Q35: When car dealers offer to do tax

Q43: A country has a population of 160

Q54: Bringing inflation down is more difficult than

Q56: Suppose you deposit $1,000 in your checking

Q96: The observation of high business activity in

Q100: When information about jobs becomes scarcer, frictional

Q104: Which of the following is included in

Q153: Variation of real GDP around the normal