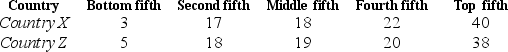

Table 21-1

Given Table 21-1, which country has a more equally distributed income? Explain your answer.

Definitions:

State Unemployment Tax

A tax paid by employers to a state fund to cover benefits for workers who have lost their jobs; rates can vary based on the employer's industry and experience with unemployment claims.

Federal Income Tax

A charge imposed by the IRS on the yearly income of individuals, corporations, trusts, and other legal entities.

Social Security Tax

Taxes collected to fund social security programs, typically levied on both employers and employees.

State Disability Insurance

A government insurance program that provides partial wage replacement to eligible workers who are unable to work due to a non-work-related illness or injury.

Q19: One of the problems in calculating the

Q28: Game theory is not necessary for understanding

Q32: The interstate on-ramp is 5.5 km west

Q39: Using indifference curves and budget constraints, graphically

Q43: Refer to Graph 22-4. Based on this

Q50: Diminishing marginal product is closely related to:<br>A)

Q74: An increase in income will cause the

Q87: The labour supply curve reflects how workers'

Q119: Refer to Table 16-5. When this game

Q122: Two masses are connected by a string