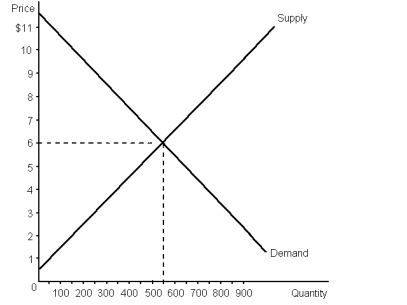

Using the graph below for cases of microwave popcorn, calculate:

a. equilibrium price.

b. equilibrium quantity.

c. consumer surplus.

d. producer surplus.

Now suppose that the government imposes a flat $2 tax per case on the sellers of microwave popcorn. Show this on the graph and calculate each of the following after the tax is imposed:

e. price paid by buyers

f. price received by sellers

g. consumer surplus

h. producer surplus

i. government revenue

j. deadweight loss

Definitions:

Total Revenue

The total amount of money received by a company from selling goods or services before any expenses are deducted.

Inverse Demand Function

A mathematical representation that describes the relationship between the price of a good and the quantity that consumers are willing and able to purchase, expressed as price as a function of quantity demanded.

Marginal Cost

The expenditure involved in the production of an extra unit of a good or service.

Elasticity of Demand

An indicator of the degree to which demand for a product changes in response to a variation in its price, shown as a percentage.

Q6: Katie owns a rabbit which loves to

Q14: In Graph 7-4, at the market-clearing equilibrium,

Q46: According to Graph 8-1, the tax caused

Q46: In part as an effort to discourage

Q61: In Graph 9-3, after the quota, deadweight

Q63: Suppose the price of product X is

Q85: In France, drivers in one central region

Q89: Price controls often help those in need.

Q92: 'Assume that the demand for entertainment is

Q106: Many advocates of raising the minimum wage