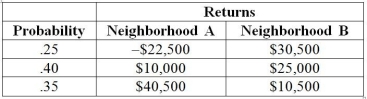

TABLE 5-7

There are two houses with almost identical characteristics available for investment in two different neighborhoods with drastically different demographic composition. The anticipated gain in value when the houses are sold in 10 years has the following probability distribution:

-Referring to Table 5-7, if you can invest 90% of your money on the house in neighborhood A and the remaining on the house in neighborhood B, what is the portfolio risk of your investment?

Definitions:

Net Flow

The difference between the inflow and outflow of funds over a specific period, often used in financial and business analysis.

Money

A medium of exchange that is widely accepted in transactions for goods and services.

Influence Exchange Rates

Refers to the impact of various economic, political, and market factors on the value of one currency in relation to another.

Fixed Exchange Rate System

A currency system where the value of a country's currency is pegged to another currency, a basket of currencies, or a commodity like gold.

Q25: Suppose that past history shows that 60%

Q29: The standard error of the sampling distribution

Q30: In a right-skewed distribution<br>A) the median equals

Q44: Referring to Table 7-7, _ % of

Q52: The covariance between two investments is equal

Q59: Referring to Table 3-3, the variance of

Q75: A stock analyst was provided with a

Q75: As the sample size increases, the standard

Q102: A survey of banks revealed the following

Q185: Referring to Table 5-7, if your investment