TABLE 9-1

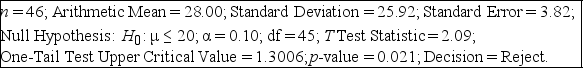

Microsoft Excel was used on a set of data involving the number of defective items found in a random sample of 46 cases of light bulbs produced during a morning shift at a plant. A manager wants to know if the mean number of defective bulbs per case is greater than 20 during the morning shift. She will make her decision using a test with a level of significance of 0.10. The following information was extracted from the Microsoft Excel output for the sample of 46 cases:

-Referring to Table 9-1, the manager can conclude that there is sufficient evidence to show that the mean number of defective bulbs per case is greater than 20 during the morning shift using a level of significance of 0.10.

Definitions:

Cost of Equity

The return a firm theoretically pays to its equity investors as compensation for the risk they undertake by investing in the company, often estimated using models like the Capital Asset Pricing Model (CAPM).

Required Returns

The minimum expected return by investors for investing in a particular asset, taking into account its risk level.

Capital Components

The various sources of funding that a company uses to finance its overall operations and growth, including debt and equity.

Pretax Cost

The expense or cost of an investment or operation before the deduction of taxes.

Q3: Referring to Table 7-1, if there are

Q4: A random sample of 50 provides a

Q19: Referring to Table 10-3, suppose α =

Q28: Referring to Table 11-5, the value of

Q36: To demonstrate a sampling method, the instructor

Q70: Referring to Table 11-4, the value of

Q88: Referring to Table 10-5, the value of

Q147: Referring to Table 9-4, if the level

Q166: Referring to Table 8-13, the critical value

Q186: Referring to Table 11-3, what should be