TABLE 9-1

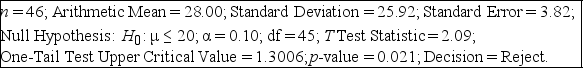

Microsoft Excel was used on a set of data involving the number of defective items found in a random sample of 46 cases of light bulbs produced during a morning shift at a plant. A manager wants to know if the mean number of defective bulbs per case is greater than 20 during the morning shift. She will make her decision using a test with a level of significance of 0.10. The following information was extracted from the Microsoft Excel output for the sample of 46 cases:

-Referring to Table 9-1, the manager can conclude that there is sufficient evidence to show that the mean number of defective bulbs per case is greater than 20 during the morning shift with no more than a 5% probability of incorrectly rejecting the true null hypothesis.

Definitions:

Physical States

The distinct forms that different phases of matter take on, commonly identified as solid, liquid, and gas.

Matter

Anything that has mass and takes up space by having volume, including solids, liquids, and gases.

Nitrogen

A chemical element with symbol N and atomic number 7, essential for all living organisms as a constituent of proteins.

Synergistic Interaction

A situation where two or more substances or actions combine to produce a total effect greater than the sum of their individual effects.

Q12: Referring to Table 9-3, the p-value of

Q15: Referring to Table 9-3, the population of

Q25: Referring to Table 7-4, the probability is

Q52: Referring to Table 8-8, it is possible

Q91: For a given data set, the confidence

Q98: Referring to Table 11-2, the null hypothesis

Q150: The test statistic measures how close the

Q167: Referring to Table 10-2, the researcher was

Q172: Referring to Table 10-15, what is the

Q185: Referring to Table 8-4, a confidence interval