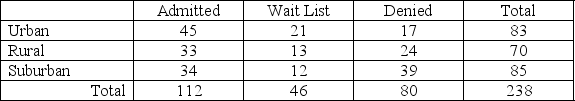

TABLE 12-11

The director of admissions at a state college is interested in seeing if admissions status (admitted, waiting list, denied admission) at his college is independent of the type of community in which an applicant resides. He takes a sample of recent admissions decisions and forms the following table:

He will use this table to do a chi-square test of independence with a level of significance of 0.01.

-Referring to Table 12-11, the null hypothesis claims that "there is no association between admission status at the college and the type of community in which an applicant resides."

Definitions:

Section 1245

A section of the tax code that involves recapturing depreciation on certain types of property as ordinary income upon sale.

Section 1231 Gain

A gain from the sale or exchange of property used in a business, subject to favorable tax treatment under Section 1231 of the U.S. tax code.

Depreciation

The process of allocating the cost of a tangible asset over its useful life, reflecting the decrease in value over time.

AGI

Adjusted Gross Income is a measure of income calculated from your gross income and used to determine how much of your income is taxable.

Q35: Referring to Table 10-15, what assumptions are

Q45: A powerful women's group has claimed that

Q91: Referring to Table 11-3, the test is

Q154: Referring to Table 14-8, the critical value

Q167: Referring to Table 13-7, which of the

Q183: In calculating the standard error of the

Q202: Referring to Table 10-8, construct a 90%

Q219: Referring to Table 14-3, to test for

Q295: Referring to Table 14-5, what is the

Q342: Referring to Table 14-4, at the 0.01