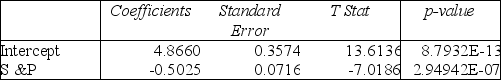

TABLE 13-7

An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the S&P 500, then it is possible to reduce the variability of the portfolio's return. In other words, one can create a portfolio with positive returns but less exposure to risk.

A sample of 26 years of S&P 500 index and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 index, is collected. A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 index (X) to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance. The results are given in the following Excel output.

Note: 2.94942E-07 = 2.94942*10⁻⁷

-Referring to Table 13-7, which of the following will be a correct conclusion?

Definitions:

Cross-Price Elasticity

A measure of how the quantity demanded of one good responds to a change in the price of another good, indicating the degree of substitutability or complementarity between them.

Substitutes

Products or services that can replace or serve as alternatives to another, often influencing consumer choices and market competition.

Income Elasticity

A measure of how much the quantity demanded of a good responds to a change in consumers' income, holding all other factors constant.

Normal Good

A good for which a rise in income increases the demand for that good—the “normal” case.

Q31: Referring to Table 13-5, the standard error

Q44: Referring to Table 13-3, suppose the director

Q63: Referring to Table 11-12, the critical value

Q116: Referring to Table 14-7, the department head

Q132: Referring to Table 14-7, the department head

Q144: An agronomist wants to compare the crop

Q160: The chi-square test of independence requires that

Q222: Referring to Table 14-17 Model 1, which

Q255: Referring to Table 14-17 Model 1, there

Q342: Referring to Table 14-4, at the 0.01