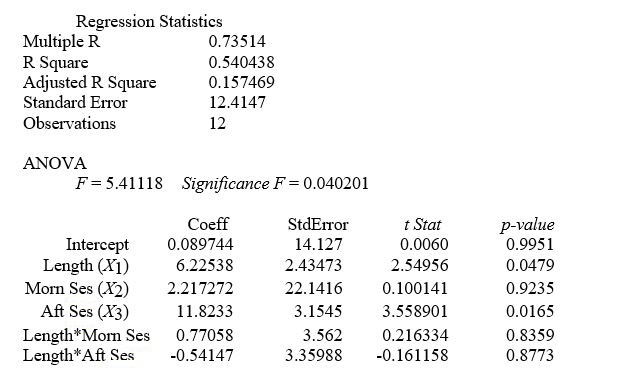

TABLE 14-11

A weight-loss clinic wants to use regression analysis to build a model for weight-loss of a client (measured in pounds) . Two variables thought to affect weight-loss are client's length of time on the weight-loss program and time of session. These variables are described below:

Y = Weight-loss (in pounds)

X₁ = Length of time in weight-loss program (in months)

X₂ = 1 if morning session, 0 if not

X₃ = 1 if afternoon session, 0 if not (Base level = evening session)

Data for 12 clients on a weight-loss program at the clinic were collected and used to fit the interaction model:

Y = β₀ + β₁X₁ + β₂X₂ + β₃X₃ + β₄X₁X₂ + β₅X₁X₂ + ε

Partial output from Microsoft Excel follows:

-Referring to Table 14-11, in terms of the βs in the model, give the mean change in weight-loss (Y) for every 1 month increase in time in the program (X₁) when attending the afternoon session.

Definitions:

Health Insurance Payments

Payments made by individuals or their employers to cover medical expenses and health care costs.

AGI Deduction

Deductions from gross income that are allowed in computing for Adjusted Gross Income (AGI), affecting eligibility for various tax credits and deductions.

Early Withdrawal

Withdrawing funds from an investment or retirement account before a predetermined age or period, often resulting in penalties.

AGI Deduction

A reduction allowed in computing an individual's Adjusted Gross Income, which can include certain business expenses, educational expenses, or health savings account contributions.

Q10: Which of the following is used to

Q19: Referring to Table 12-15, the director should

Q27: Referring to Table 12-9, at 5% level

Q38: Referring to Table 16-6, the fitted trend

Q77: Referring to Table 16-14, to obtain a

Q81: Referring to Table 14-15, the alternative hypothesis

Q170: Referring to Table 12-15, what is the

Q237: Referring to Table 14-11, in terms of

Q244: Referring to Table 14-17 Model 1, what

Q337: Referring to Table 14-2, for these data,