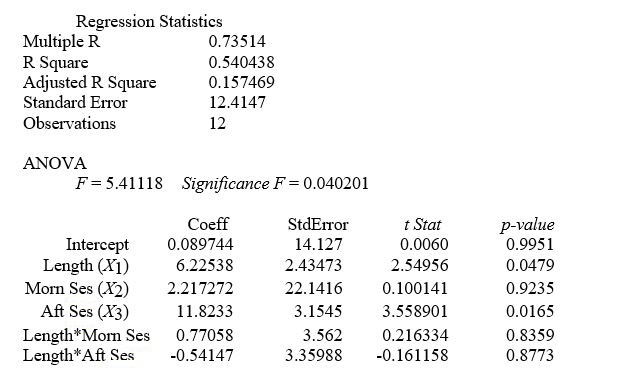

TABLE 14-11

A weight-loss clinic wants to use regression analysis to build a model for weight-loss of a client (measured in pounds). Two variables thought to affect weight-loss are client's length of time on the weight-loss program and time of session. These variables are described below:

Y = Weight-loss (in pounds)

X₁ = Length of time in weight-loss program (in months)

X₂ = 1 if morning session, 0 if not

X₃ = 1 if afternoon session, 0 if not (Base level = evening session)

Data for 12 clients on a weight-loss program at the clinic were collected and used to fit the interaction model:

Y = β₀ + β₁X₁ + β₂X₂ + β₃X₃ + β₄X₁X₂ + β₅X₁X₂ + ε

Partial output from Microsoft Excel follows:

-Referring to Table 14-11, the overall model for predicting weight-loss (Y) is statistically significant at the 0.05 level.

Definitions:

Competitive Environment

A market scenario where businesses are in competition with each other to attract customers and achieve higher sales.

Free Association

A psychological technique in which a person responds to a word or idea spontaneously with the first word or idea that comes to mind.

Unaided Recall

A measure of memory where respondents reveal what brands or products come to mind without any cues or prompts.

Brand

The identity, including the name, symbol, or design, that distinguishes a product or company from its competitors in the eyes of the customer.

Q10: Referring to Table 13-13, the conclusion on

Q15: Referring to Table 13-6, which of the

Q41: The Variance Inflationary Factor (VIF) measures the

Q99: In selecting a forecasting model, you should

Q112: Referring to 14-16, the 0 to 60

Q113: Referring to Table 14-4, which of the

Q117: Referring to Table 14-17 Model 1, the

Q244: Referring to Table 14-17 Model 1, what

Q275: Referring to Table 14-15, there is sufficient

Q352: Referring to Table 14-3, the p-value for