TABLE 14-4

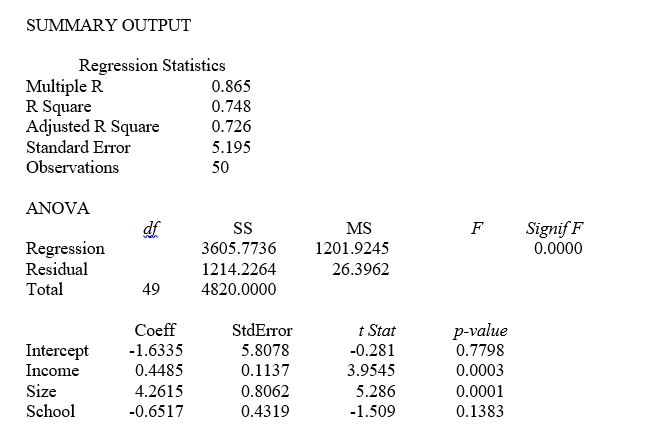

A real estate builder wishes to determine how house size (House) is influenced by family income (Income) , family size (Size) , and education of the head of household (School) . House size is measured in hundreds of square feet, income is measured in thousands of dollars, and education is in years. The builder randomly selected 50 families and ran the multiple regression. Microsoft Excel output is provided below:

-Referring to Table 14-4, which of the following values for the level of significance is the smallest for which at least two explanatory variables are significant individually?

Definitions:

Progressive

Referring to policies or tax rates that increase proportionally with the ability to pay, targeting a higher burden on wealthier entities or individuals.

Price Elasticity

A measure of how much the quantity demanded of a good responds to a change in the price of that good, often used to understand the sensitivity of demand in relation to price changes.

Excise Tax

A form of taxation applied on certain goods, services, or activities, often included in the price of products like gasoline, alcohol, and tobacco.

Incidence

The measurement or frequency of occurrence, often used in the context of the distribution of a tax burden.

Q25: Referring to Table 15-6, what is the

Q30: Referring to Table 11-12, the mean square

Q98: The coefficient of multiple determination measures the

Q101: Referring to Table 13-7, to test whether

Q104: Which of the following is a "robust"

Q107: Referring to Table 12-15, what is the

Q134: Referring to Table 16-5, the number of

Q145: Referring to Table 12-6, what is the

Q184: Referring to Table 14-3, the p-value for

Q188: Referring to Table 12-13, the test is