TABLE 15-6

Given below are results from the regression analysis on 40 observations where the dependent variable is the number of weeks a worker is unemployed due to a layoff (Y) and the independent variables are the age of the worker (X₁), the number of years of education received (X₂), the number of years at the previous job (X₃), a dummy variable for marital status (X₄: 1 = married, 0 = otherwise), a dummy variable for head of household (X₅: 1 = yes, 0 = no) and a dummy variable for management position (X₆: 1 = yes, 0 = no).

The coefficient of multiple determination (R) for the regression model using each of the 6 variables Xⱼ as the dependent variable and all other X variables as independent variables are, respectively, 0.2628, 0.1240, 0.2404, 0.3510, 0.3342 and 0.0993.

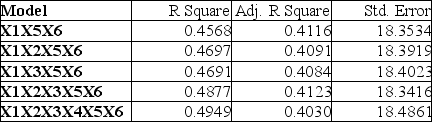

The partial results from best-subset regression are given below:

-Referring to Table 15-6, what is the value of the variance inflationary factor of Married?

Definitions:

Cognitive Development

The process of growth and change in intellectual/mental abilities such as thinking, reasoning, and understanding over the lifespan.

Jean Piaget

A Swiss psychologist known for his pioneering work in child development, particularly his theory of cognitive development.

Surveys

Research methods involving questionnaires or interviews used to collect data from specific populations.

Nightmares

Disturbing dreams that cause the dreamer to wake up feeling anxious and frightened; often related to stress or trauma.

Q3: Referring to Table 17-8, construct an <img

Q9: A realtor wants to compare the variability

Q56: Collinearity is present when there is a

Q66: Referring to Table 15-3, suppose the chemist

Q69: Referring to Table 15-5, what is the

Q117: Referring to Table 16-10, the value of

Q119: MAD is the summation of the residuals

Q124: Referring to Table 13-13, the degrees of

Q152: Referring to Table 14-17 Model 1, which

Q226: Referring to Table 14-17 Model 1, _