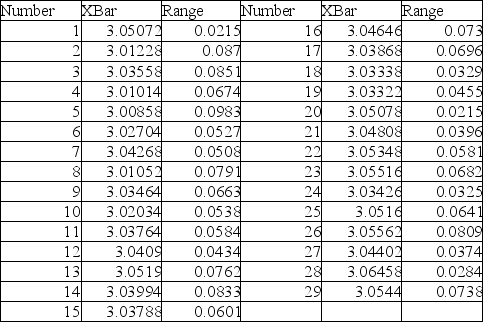

TABLE 17-9

The manufacturer of canned food constructed control charts and analyzed several quality characteristics. One characteristic of interest is the weight of the filled cans. The lower specification limit for weight is 2.95 pounds. The table below provides the range and mean of the weights of five cans tested every fifteen minutes during a day's production.

-Referring to Table 17-9, construct an  chart for the weight.

chart for the weight.

Definitions:

Payback Method

A simplistic financial analysis tool used to determine the time required for the earnings from an investment to repay the initial investment cost.

NPV Profile

A graphical representation showing the relationship between the net present value (NPV) of a project and various discount rates, helping to analyze the investment's sensitivity to changes in cost of capital.

MIRR

Modified Internal Rate of Return, a financial metric used to assess the profitability of investments, adjusting for different cash inflow and outflow timings.

IRR Method

A financial analysis tool used to evaluate the profitability of investments based on the internal rate of return, which calculates the rate at which the net present value of all cash flows is zero.

Q64: If a new machine of a production

Q71: Identifying an organization's existing vision, mission, objectives,

Q77: Referring to Table 15-6, the model that

Q77: Referring to Table 19-1, if the probability

Q116: Referring to Table 16-12, the best interpretation

Q146: If a time series does not exhibit

Q153: The minimum expected opportunity loss is also

Q210: Which of the following is not a

Q254: Referring to Table 9-3, if you select

Q308: Referring to Table 14-17 Model 1, what