TABLE 15-6

Given below are results from the regression analysis on 40 observations where the dependent variable is the number of weeks a worker is unemployed due to a layoff (Y) and the independent variables are the age of the worker (X₁), the number of years of education received (X₂), the number of years at the previous job (X₃), a dummy variable for marital status (X₄: 1 = married, 0 = otherwise), a dummy variable for head of household (X₅: 1 = yes, 0 = no) and a dummy variable for management position (X₆: 1 = yes, 0 = no).

The coefficient of multiple determination (R) for the regression model using each of the 6 variables Xⱼ as the dependent variable and all other X variables as independent variables are, respectively, 0.2628, 0.1240, 0.2404, 0.3510, 0.3342 and 0.0993.

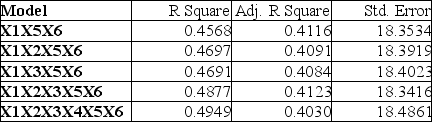

The partial results from best-subset regression are given below:

-Referring to Table 15-6, the model that includes X₁, X₂, X₅ and X₆ should be among the appropriate models using the Mallow's Cp statistic.

Definitions:

Risk-free Rate

The return on investment with no risk of financial loss, typically associated with government bonds.

Security Market Line

A graphical representation used in financial markets to show the relationship between risk (measured as beta) and expected return of investments.

Market Risk Premium

Market Risk Premium is the additional return that an investor expects to receive from holding a risky market portfolio instead of risk-free assets.

Company-specific Risk

A type of risk that affects a specific company or industry, distinguished from market-wide risk.

Q1: Referring to Table 16-4, a centered 3-year

Q9: Referring to Table 17-9, an R chart

Q16: The stepwise regression approach takes into consideration

Q20: Referring to Table 15-6, the variable X₄

Q33: Referring to Table 17-7, construct an <img

Q48: Referring to Table 17-4, what is the

Q73: Referring to Table 15-3, suppose the chemist

Q83: Referring to Table 15-6, the model that

Q195: Referring to Table 14-4, when the builder

Q257: If the number of blocks in the