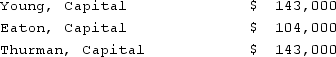

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Young's total share of net loss for the first year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Young's total share of net loss for the first year?

Definitions:

Vision

A statement or idea about what the future looks like, often used by organizations to guide long-term planning and decision-making.

Marketplace Needs

are the requirements and desires of consumers in a particular market segment, which businesses seek to satisfy through the development and offering of products or services.

Mental Exercises

Activities or practices that engage the brain, aiming to improve cognitive functions, memory, creativity, or problem-solving skills.

Brainstorming

A group creativity technique designed to generate a large number of ideas for the solution of a problem.

Q1: A patient reports sustained, irregular heart palpitations.

Q6: All of the following are holdings of

Q9: Name the Charlie Chaplin sound film that

Q11: Lord of the Rings, Harry Potter, and

Q22: Why are the terms of the Articles

Q36: On May 1, 2021, Mosby Company received

Q41: During World War II, which export market

Q53: Certain balance sheet accounts of a foreign

Q74: Donald, Anne, and Todd have the following

Q98: Strickland Company sells inventory to its parent,