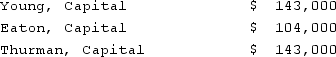

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Eaton's total share of net loss for the first year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Eaton's total share of net loss for the first year?

Definitions:

Q3: Quadros Inc., a Portuguese firm was acquired

Q5: In 2018, this movie-ticket subscription service shook

Q10: Strickland Company sells inventory to its parent,

Q38: Name the melodrama that focuses on a

Q39: Which studio mogul is credited with starting

Q45: Schrute Inc. had a receivable from a

Q48: Which of the following best describe Coppola's

Q49: Palmer Corp. owned 80% of the outstanding

Q61: The capital account balances for Donald &

Q102: On December 1, 2021, Keenan Company, a