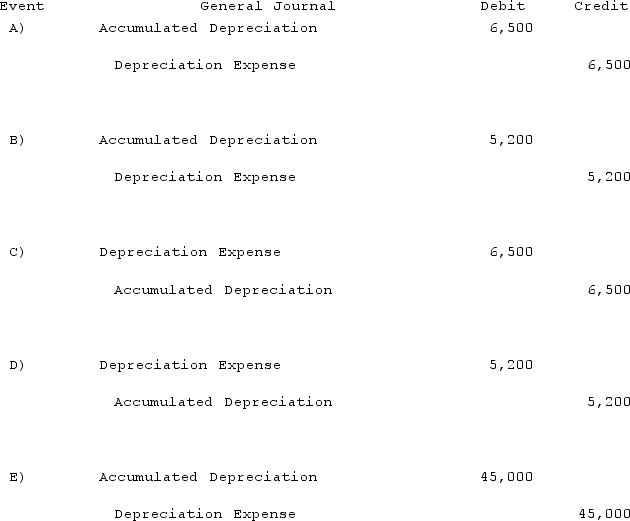

Palmer Corp. owned 80% of the outstanding common stock of Creed Inc. On January 1, 2019, Palmer acquired a building with a ten-year life for $450,000. No salvage value was anticipated and the building was to be depreciated on the straight-line basis. On January 1, 2021, Palmer sold this building to Creed for $412,000. At that time, the building had a remaining life of eight years but still no expected salvage value. For consolidation purposes, what is the Excess Depreciation (ED entry) for this building for 2021?

Definitions:

Investment Return

The profit or loss derived from investing capital, including dividends, capital gains, and interest.

Retaining Earnings

The practice of holding onto a company's profits to reinvest in the business rather than distributing them as dividends to shareholders.

Net Worth

The total assets minus total outside liabilities of an individual or a company.

Interest Rate

The cost of borrowing money or the return on savings, expressed as a percentage of the principal.

Q4: What are some reasons that a business

Q56: The financial statements for Campbell, Inc., and

Q57: Oscar, Ltd. is a British subsidiary of

Q70: Goodman, Pinkman, and White formed a partnership

Q74: Pell Company acquires 80% of Demers Company

Q75: Which of the following will result in

Q94: The balance sheets of Butler, Inc. and

Q99: All of the following data may be

Q103: On October 1, 2021, Eagle Company forecasts

Q105: Jackson Company acquires 100% of the stock