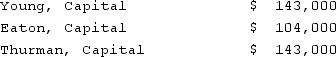

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was the balance in Eaton's Capital account at the end of the first year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was the balance in Eaton's Capital account at the end of the first year?

Definitions:

Nonprogrammed

Decisions or actions that are made to address unique, non-recurring situations that require specific handling.

Programmed

Refers to actions, decisions, or operations that are established in advance through a set of rules or algorithms.

Nonprogrammed

relates to decision-making or solutions that are not based on established procedures or guidelines, often required in unique, unforeseen, or complex situations.

Complex Nature

The intricate and multifaceted characteristics of a system, problem, or entity that make it challenging to understand or manage.

Q14: On January 1, 2021, A. Hamilton, Inc.

Q20: While Hollywood made documentary and newsreel films

Q22: Which genre is defined by its collective

Q25: Anderson, Inc. has owned 70% of its

Q32: This term describes the independent film phenomenon

Q38: Name the studio whose style was synonymous

Q43: How do intra-entity transfers of inventory affect

Q49: P, L, and O are partners with

Q54: On January 1, 2021, Pride, Inc. acquired

Q69: Perez Company, a Mexican subsidiary of a