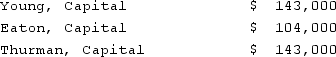

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Young's total share of net income for the second year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Young's total share of net income for the second year?

Definitions:

Electric Cars

Vehicles that are powered by electric motors, using energy stored in rechargeable batteries, which are considered more environmentally friendly compared to conventional gasoline-powered cars.

Gasoline Prices

Refers to the cost per unit volume of gasoline, typically measured in gallons or liters, influenced by factors such as oil prices, taxes, and supply-demand dynamics.

Marketing Planning Process

A systematic approach to identifying opportunities, defining objectives, and developing strategies and plans to market products or services successfully.

Marketing Mix

The combination of factors that can be controlled by a company to influence consumers to purchase its products, often summarized as the four Ps: product, price, place, and promotion.

Q10: James, Keller, and Rivers have the following

Q17: The staging in the "young Charles Foster

Q17: Describe the factors that led to the

Q19: Which Billy Wilder film deals with a

Q31: Pepe, Incorporated acquired 60% of Devin Company

Q31: This Abbott and Costello comedy was censored

Q33: Norr and Caylor established a partnership on

Q66: Ginvold Co. began operating a subsidiary in

Q75: Quadros Inc., a Portuguese firm was acquired

Q89: On January 1, 2021, Rhodes Co. owned