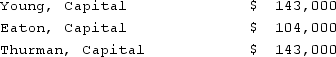

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Eaton's total share of net income for the second year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Eaton's total share of net income for the second year?

Definitions:

Clinician Bias

The preconceived notions and judgments that a healthcare provider might unconsciously hold towards a patient, potentially influencing diagnostic or treatment decisions.

DSM Revisions

Changes and updates made to the Diagnostic and Statistical Manual of Mental Disorders, a handbook used by healthcare professionals as the authoritative guide to diagnose mental disorders.

Diagnostic Criteria

A set of standardized guidelines used to identify and classify diseases or disorders.

Family History

The health and medical histories of relatives, which can indicate an individual's risk for certain genetic or hereditary conditions.

Q11: Name the studio mogul who moved his

Q18: You've won the lottery and you want

Q24: You've won the lottery and you want

Q27: Which industry assisted in the production of-and

Q29: On January 1, 2020, Smeder Company, an

Q40: Pepe, Incorporated acquired 60% of Devin Company

Q58: Certain balance sheet accounts of a foreign

Q90: Webb Company purchased 90% of Jones Company

Q97: A subsidiary of Reynolds Inc., a U.S.

Q101: MacDonald, Inc. owns 80% of the outstanding