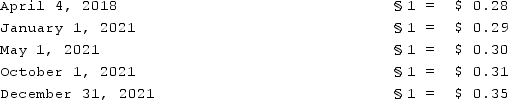

Boerkian Co. started 2021 with two assets: Cash of §26,000 (Stickles)and Land that originally cost §72,000 when acquired on April 4, 2018. On May 1, 2021, the company rendered services to a customer for §36,000, an amount immediately paid in cash. On October 1, 2021, the company incurred an operating expense of §22,000 that was immediately paid. No other transactions occurred during the year so an average exchange rate is not necessary. Currency exchange rates were as follows:

Required:Assume that Boerkian was a foreign subsidiary of a U.S. multinational company and the local currency of the subsidiary (stickle)is the functional currency. On the December 31, 2021 balance sheet, what was the translated value of the Land account?

Required:Assume that Boerkian was a foreign subsidiary of a U.S. multinational company and the local currency of the subsidiary (stickle)is the functional currency. On the December 31, 2021 balance sheet, what was the translated value of the Land account?

Definitions:

Performance Appraisals

The evaluation of an employee's job performance, typically conducted regularly to assess contributions and determine areas for improvement.

Morning Bias

The tendency for individuals to have improved cognitive functions and mood soon after waking up, affecting their decision-making and productivity.

Negative Stereotype

A harmful or unfavorable generalization about a group of people that lacks individual recognition and is often based on misconceptions.

Performance Appraisals

The formal evaluation process of an employee's job performance, usually involving feedback and discussions about achievements and areas for improvement.

Q21: The capital account balances for Donald &

Q23: The use of tracking shots in the

Q29: On January 1, 2020, Smeder Company, an

Q32: The ABCD Partnership has the following balance

Q38: Name the melodrama that focuses on a

Q56: A partnership began its first year of

Q88: A local partnership has two partners, Jim

Q101: Pell Company acquires 80% of Demers Company

Q106: On January 1, 2020, John Doe Enterprises

Q109: Pell Company acquires 80% of Demers Company