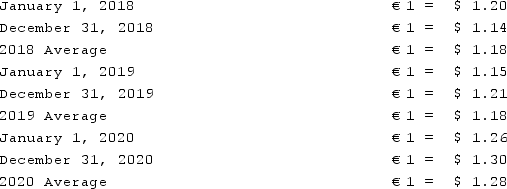

A subsidiary of Reynolds Inc., a U.S. company, was located in a foreign country. The local currency of this subsidiary was the Euro (€) while the functional currency of this subsidiary was the U.S. dollar. The subsidiary acquired Equipment A on January 1, 2018, for €250,000. Depreciation expense associated with Equipment A was €25,000 per year. On January 1, 2020, the subsidiary acquired Equipment B for €150,000 and Equipment B had associated depreciation expense of €10,000. The subsidiary owned no other depreciable assets. Currency exchange rates between the U.S. dollar and the Euro were as follows:  What amount would have been reported for depreciation expense related to the equipment owned by the subsidiary in Reynolds's consolidated balance sheet at December 31, 2018?

What amount would have been reported for depreciation expense related to the equipment owned by the subsidiary in Reynolds's consolidated balance sheet at December 31, 2018?

Definitions:

Great Depression

A significant international economic collapse that happened during the 1930s.

Bank Failures

Occur when a bank is unable to meet its obligations to depositors or creditors and is either closed or taken over by regulatory authorities.

Bank Management

The process of overseeing and running a bank's day-to-day operations and financial activities.

Barter

An exchange method where goods and services are directly traded for other goods and services without using a medium of exchange, like money.

Q6: Lynne Ramsay's 2018 film You Were Never

Q8: Name the real-life subject whose life story

Q9: In the wake of the 2016 presidential

Q22: Describe Hollywood's initial approach to political filmmaking

Q39: Sofia Coppola won this major award for

Q40: Which 21st-century movie star best matches Bette

Q41: Under the temporal method, property, plant &

Q46: Which of the following processes was utilized

Q59: When preparing a consolidation worksheet for a

Q83: Anderson Company, a 90% owned subsidiary of