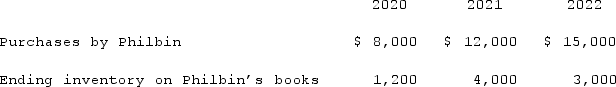

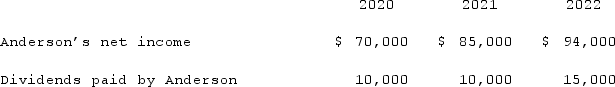

Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin's intra-entity purchases from Anderson. Anderson was acquired on January 1, 2020.  Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.

Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends. For consolidation purposes, what amount would be debited to cost of goods sold for the 2022 consolidation worksheet with regard to the unrecognized intra-entity gross profit remaining in ending inventory with respect to the 2022 intra-entity transfer of merchandise?

For consolidation purposes, what amount would be debited to cost of goods sold for the 2022 consolidation worksheet with regard to the unrecognized intra-entity gross profit remaining in ending inventory with respect to the 2022 intra-entity transfer of merchandise?

Definitions:

Q1: In a situation where the investor exercises

Q8: Farley Brothers, a U.S. company, had a

Q28: Throughout 2021, Flenderson Co. sold inventory to

Q73: How does a gain on an intra-entity

Q86: Daniels Inc. acquired 85% of the outstanding

Q93: Following are selected accounts for Green Corporation

Q101: On March 1, 2021, Mattie Company received

Q106: On January 1, 2020, John Doe Enterprises

Q108: Elon Corp. obtained all of the common

Q122: When consolidating a subsidiary under the equity