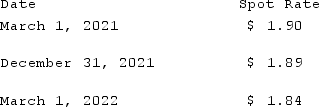

On March 1, 2021, Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds. The machine was shipped and payment was received on March 1, 2022. On March 1, 2021, Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1, 2022 at a price of $380,000. Mattie properly designates the option as a fair hedge of the pound firm commitment. The option cost $2,000 and had a fair value of $2,200 on December 31, 2021. The following spot exchange rates apply:  Mattie's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the net increase or decrease in cash flow from having purchased the foreign currency option to hedge this exposure to foreign exchange risk?

Mattie's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the net increase or decrease in cash flow from having purchased the foreign currency option to hedge this exposure to foreign exchange risk?

Definitions:

Neural Pathway

A series of connected neurons that transmit signals between different parts of the brain or between the brain and the rest of the nervous system.

Fovea

A small depression in the retina of the eye where visual acuity is highest, due to a high concentration of cones.

Phonemic Distinctions

The ability to recognize and differentiate between distinct phonemes, which are the smallest units of sound that can change the meaning of a word.

Native Language

The first language a person learns to speak, which is usually the language spoken in the family or community in which they were raised.

Q12: Vickers Inc. acquired all of the common

Q12: A subsidiary of Reynolds Inc., a U.S.

Q22: This industry term refers to the practice

Q26: Which New Hollywood auteur struggled throughout the

Q35: Which Robert Altman film featured low-light interior

Q42: A net asset balance sheet exposure exists

Q54: When Danny withdrew from John, Daniel, Harry,

Q74: Flintstone Inc. acquired all of Rubble Co.

Q101: On January 1, 2020, Barber Corp. paid

Q105: Potter Corp. (a U.S. company in Colorado)had