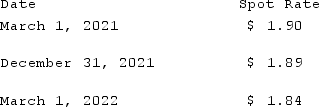

On March 1, 2021, Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds. The machine was shipped and payment was received on March 1, 2022. On March 1, 2021, Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1, 2022 at a price of $380,000. Mattie properly designates the option as a fair hedge of the pound firm commitment. The option cost $2,000 and had a fair value of $2,200 on December 31, 2021. The following spot exchange rates apply:  Mattie's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the net increase or decrease in cash flow from having purchased the foreign currency option to hedge this exposure to foreign exchange risk?

Mattie's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the net increase or decrease in cash flow from having purchased the foreign currency option to hedge this exposure to foreign exchange risk?

Definitions:

Organizational Efficiency

Measures how effectively an organization utilizes its resources (time, money, personnel) to achieve its goals without waste.

Goal Setting

The method of pinpointing objectives that are specific, measurable, attainable, pertinent, and limited by time for successful accomplishment.

Different Reward Programs

Various schemes or plans designed to motivate and compensate employees or participants, often including financial incentives, benefits, or non-material recognitions.

Goal Difficulty

The extent to which a goal is challenging and requires effort to achieve, often impacting motivation levels.

Q2: Which one of the traits below was

Q5: The western film genre often deals with

Q8: Approximately what percentage of a film's income

Q15: Where is the translation adjustment reported in

Q18: On January 1, 2019, Palk Corp. and

Q18: Which studio formed an alliance with the

Q50: Jackson Corp. (a U.S.-based company)sold parts to

Q66: Ginvold Co. began operating a subsidiary in

Q111: The accounting problems encountered in consolidated intra-entity

Q119: Key Company has had bonds payable of