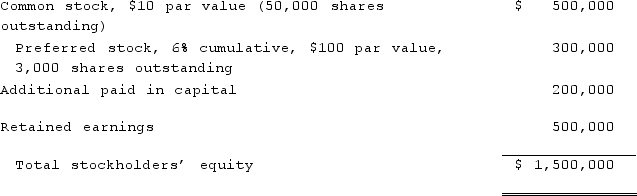

On January 1, 2021, Nichols Company acquired 80% of Smith Company's common stock and 40% of its non-voting, cumulative preferred stock. The consideration transferred by Nichols was $1,200,000 for the common and $124,000 for the preferred. There was no premium in the value of consideration transferred. Any excess acquisition-date fair value over book value is considered goodwill. The capital structure of Smith immediately prior to the acquisition is:  With respect to Nichols' investment in Smith, determine the amount to be recorded and identify which account should be adjusted to reflect such amount.

With respect to Nichols' investment in Smith, determine the amount to be recorded and identify which account should be adjusted to reflect such amount.

Definitions:

Ski Boots

Footwear specifically designed for skiing, providing support and enabling the skier to control the skis.

Purchase of Suits

Purchase of suits refers to the acquisition of formal clothing items, recorded as a business expense if used for professional purposes.

Men's Coats

Clothing items designed specifically for men to wear over their other garments for warmth or protection.

Department Store

A large retail establishment offering a wide range of consumer goods across different product categories under one roof.

Q8: Strayten Corp. is a wholly owned subsidiary

Q24: A partnership began its first year of

Q25: Scott Co. acquired 70% of Gregg Co.

Q49: The following information has been taken from

Q58: Private companies, with respect to goodwill:<br>A)May elect

Q88: Several years ago, Polar Inc. acquired an

Q90: Prevatt, Inc. owns 80% of Franklin Company.

Q96: Charleston Inc. acquired 75% of Savannah Manufacturing

Q96: Which of the following is not an

Q97: Anderson Company, a 90% owned subsidiary of