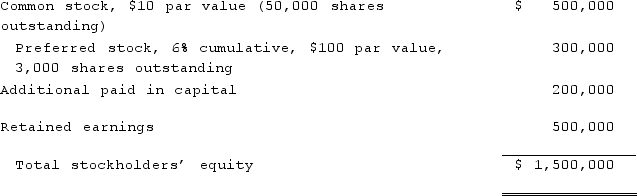

On January 1, 2021, Nichols Company acquired 80% of Smith Company's common stock and 40% of its non-voting, cumulative preferred stock. The consideration transferred by Nichols was $1,200,000 for the common and $124,000 for the preferred. There was no premium in the value of consideration transferred. Any excess acquisition-date fair value over book value is considered goodwill. The capital structure of Smith immediately prior to the acquisition is:  The consolidation entry at date of acquisition will include (referring to Smith) :

The consolidation entry at date of acquisition will include (referring to Smith) :

Definitions:

Self-Interest

Acting in a way that is most personally beneficial, often used in economics to describe behavior in markets.

Insurance Premiums

The amount paid periodically to an insurance company by policyholders for coverage and to keep the policy active.

Central Planning

An economic system where decisions about production, investment, and distribution are made by the government or a central authority.

Consumer Sovereignty

The concept that consumers' preferences determine the production of goods and services, guiding the allocation of resources in a market.

Q2: What is an intra-entity gross profit on

Q2: Thanks to the work of the #OscarsSoWhite

Q5: In 2018, this movie-ticket subscription service shook

Q11: Which of the following statements is true

Q31: Pepe, Incorporated acquired 60% of Devin Company

Q69: Pell Company acquires 80% of Demers Company

Q70: Esposito is an Italian subsidiary of a

Q89: On January 1, 2021, Lamb and Mona

Q102: A statutory merger is a(n)<br>A)Business combination in

Q118: Anderson Company, a 90% owned subsidiary of