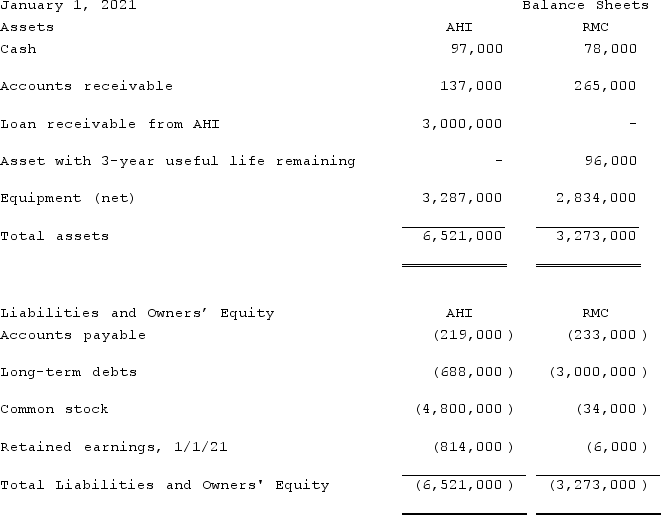

On January 1, 2021, A. Hamilton, Inc. ("AHI") provides a loan for $3,000,000 to Reynolds Manufacturing Corp. ("RMC") . The terms of the loan require payment of the loan no later than January 1, 2026. RMC was in terrible financial condition and would cease operations absent securing a loan. Prior to requesting a loan from AHI, RMC exhausted all other possible avenues for funding. The terms of the loan agreement include provisions that require RMC to provide AHI with the following from January 1, 2021 through January 1, 2026: (i) 6% annual interest on the principal amount of the loan, which reflects a market rate of interest; (ii) 100% participation rights to RMC's profits less $17,000 in a guaranteed annual dividend to RMC's common shareholders; and (iii) complete decision-making authority over RMC's operations and financing decisions.At the end of the term of the loan, AHI is given the right to acquire RMC or, in its discretion, extend the term of the original loan an additional 5 years. At the date the loan was extended to RMC, RMC's common stock had an estimated fair value of $136,000 and a book value of $40,000. The $96,000 difference was attributed to an asset with a 3-year useful life remaining ("Asset") . At January 1, 2021, the balance sheets for AHI and RMC are as follows:  In preparing the consolidation worksheet as of December 31, 2021 for AHI and RMC, which of the following worksheet entry descriptions reflects what AHI should do to consolidate the financial statements?

In preparing the consolidation worksheet as of December 31, 2021 for AHI and RMC, which of the following worksheet entry descriptions reflects what AHI should do to consolidate the financial statements?

Definitions:

Empirically Unsupported

Refers to theories, methods, or practices that lack sufficient evidence from scientific research to validate their effectiveness or accuracy.

Attachment Therapies

A range of therapeutic approaches aimed at treating psychological disorders by focusing on the importance of forming healthy emotional bonds during early childhood.

Beta Blockers

A class of medications that reduce blood pressure by blocking the effects of adrenaline on the body's beta receptors.

Anxiety Disorders

A group of mental health disorders that includes generalized anxiety disorder, panic disorder, and phobias, characterized by excessive fear or anxiety.

Q4: Pell Company acquires 80% of Demers Company

Q5: On December 1, 2021, Keenan Company, a

Q18: Flynn acquires 100 percent of the outstanding

Q42: When consolidating parent and subsidiary financial statements,

Q43: This film producer is primarily identified by

Q44: On January 1, 2021, Pride, Inc. acquired

Q51: The dissolution of a partnership occurs<br>A)only when

Q52: McCoy has the following account balances as

Q83: McGuire Company acquired 90 percent of Hogan

Q98: Webb Company purchased 90% of Jones Company