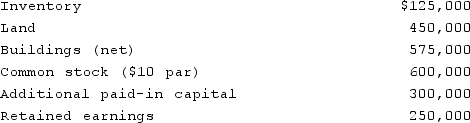

McCoy has the following account balances as of December 31, 2020 before an acquisition transaction takes place.  The fair value of McCoy's Land and Buildings are $650,000 and $600,000, respectively. On December 31, 2020, Ferguson Company issues 30,000 shares of its $10 par value ($30 fair value) common stock in exchange for all of the shares of McCoy's common stock. Ferguson paid $12,000 for costs to issue the new shares of stock. Before the acquisition, Ferguson has $800,000 in its common stock account and $350,000 in its additional paid-in capital account.What will be the consolidated additional paid-in capital as a result of this acquisition?

The fair value of McCoy's Land and Buildings are $650,000 and $600,000, respectively. On December 31, 2020, Ferguson Company issues 30,000 shares of its $10 par value ($30 fair value) common stock in exchange for all of the shares of McCoy's common stock. Ferguson paid $12,000 for costs to issue the new shares of stock. Before the acquisition, Ferguson has $800,000 in its common stock account and $350,000 in its additional paid-in capital account.What will be the consolidated additional paid-in capital as a result of this acquisition?

Definitions:

FICA Medicare

FICA Medicare refers to the portion of the Federal Insurance Contributions Act tax that is designated for Medicare, providing health insurance for individuals over 65 and some younger people with disabilities.

Gross Pay

The total amount of money earned by an employee before any deductions or taxes are applied.

Regular Rate

The hourly pay rate that is used to calculate overtime pay for non-exempt employees according to the Fair Labor Standards Act (FLSA).

Excess Hours

Hours worked beyond the normal or scheduled work time, often considered overtime.

Q7: Large companies can typically lower costs per

Q30: When Valley Co. acquired 80% of the

Q36: On January 1, 2021, the Moody Company

Q42: McGuire Company acquired 90 percent of Hogan

Q51: What is a safe cash payment?

Q61: Cayman Inc. bought 30% of Maya Company

Q76: A variable interest entity can take all

Q84: Pennant Corp. owns 70% of the common

Q102: Following are selected accounts for Green Corporation

Q122: When consolidating a subsidiary under the equity