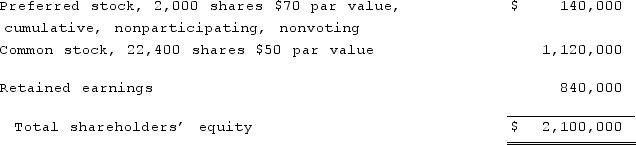

On January 1, 2021, Bast Co. had a net book value of $2,100,000 as follows:

Fisher Co. acquired all of the outstanding preferred shares for $148,000 and 60% of the common stock for $1,281,000. Fisher believed that one of Bast's buildings, with a twelve-year life, was undervalued on the company's financial records by $70,000.Required:What is the amount of goodwill to be recognized from this purchase?

Fisher Co. acquired all of the outstanding preferred shares for $148,000 and 60% of the common stock for $1,281,000. Fisher believed that one of Bast's buildings, with a twelve-year life, was undervalued on the company's financial records by $70,000.Required:What is the amount of goodwill to be recognized from this purchase?

Definitions:

Work In Process Inventory

Inventory that includes all the materials, labor, and overhead costs for products that are in the production process but not yet complete.

Custom-Made Goods

Products that are specially made to the specifications of a customer rather than mass-produced.

Conversion Costs

Conversion Costs are expenses incurred during the transformation of raw materials into finished goods, specifically including manufacturing labor and overhead.

Factory Overhead

Indirect costs related to the manufacturing process, such as utilities, maintenance, and manager salaries that cannot be directly attributed to the production of specific goods.

Q8: Pell Company acquires 80% of Demers Company

Q11: Lord of the Rings, Harry Potter, and

Q12: A subsidiary of Reynolds Inc., a U.S.

Q40: On December 1, 2021, Keenan Company, a

Q77: On April 1, 2020, Shannon Company, a

Q79: Bassett Inc. acquired all of the outstanding

Q79: Regency Corp. recently acquired $500,000 of the

Q87: A partnership began its first year of

Q117: According to the FASB ASC regarding the

Q126: On January 1, 2021, Daniel Corp. acquired