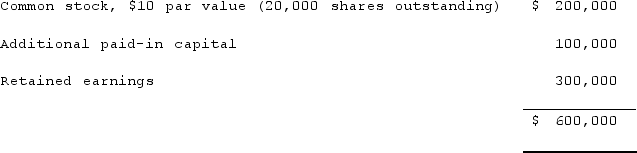

Panton, Inc. acquired 18,000 shares of Glotfelty Corp. several years ago for $30 per share when Glotfelty had a book value of $450,000. Before and after that time, Glotfelty's stock traded at $30 per share. At the present time, Glotfelty reports the following stockholders' equity:

Glotfelty issues 5,000 shares of previously unissued stock to the public for $40 per share. None of this stock is purchased by Panton.Prepare Panton's journal entry to recognize the impact of this transaction.

Glotfelty issues 5,000 shares of previously unissued stock to the public for $40 per share. None of this stock is purchased by Panton.Prepare Panton's journal entry to recognize the impact of this transaction.

Definitions:

Theft

An act of stealing; unlawfully taking another's property without their consent.

Damage

The physical harm or impairment to property or goods, potentially leading to financial loss or liability.

Periodic Inventory System

A method of inventory valuation in which physical inventory counts are conducted at specific intervals to determine cost of goods sold and ending inventory levels.

Physical Count

The process of manually counting and verifying the quantities of physical inventory in a business.

Q7: The following information has been taken from

Q8: When is a goodwill impairment loss recognized?<br>A)Annually

Q15: Which of the following is not a

Q19: Presented below are the financial balances for

Q30: Where do dividends paid by a subsidiary

Q34: Sumner Redstone heads this conglomerate, which owns

Q44: Coyote Corp. (a U.S. company in Texas)had

Q67: A parent company owns a controlling interest

Q71: Thomas Inc. had the following stockholders' equity

Q93: Which of the following statements is true