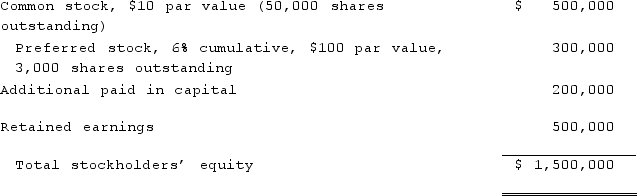

On January 1, 2021, Nichols Company acquired 80% of Smith Company's common stock and 40% of its non-voting, cumulative preferred stock. The consideration transferred by Nichols was $1,200,000 for the common and $124,000 for the preferred. There was no premium in the value of consideration transferred. Any excess acquisition-date fair value over book value is considered goodwill. The capital structure of Smith immediately prior to the acquisition is:  If Smith's net income is $100,000 in the year following the acquisition,

If Smith's net income is $100,000 in the year following the acquisition,

Definitions:

Negotiable Instrument

A written document guaranteeing the payment of a specific amount of money, either on demand or at a set time, with the payer named on the document.

Uniform Commercial Code

A comprehensive set of laws governing all commercial transactions in the United States, aiming to standardize and provide a legal framework for businesses and individuals engaging in commerce.

Previously Undisclosed Principal

A principal whose identity was not revealed by the agent at the time of entering into a contract with a third party.

Third Party

An entity that is not directly involved in a transaction or contract but may be affected by it or may have interests that are affected.

Q14: Kennedy Company acquired all of the outstanding

Q17: McGuire Company acquired 90 percent of Hogan

Q26: Which of the following were reasons Paramount

Q29: On January 1, 2021, the Moody Company

Q42: On December 1, 2021, King Co. sold

Q43: Virginia Corp. owned all of the voting

Q47: How do outstanding subsidiary stock warrants affect

Q95: Watkins, Inc. acquires all of the outstanding

Q101: On January 1, 2020, Barber Corp. paid

Q118: The balance sheets of Butler, Inc. and