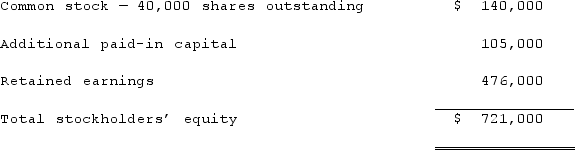

Popper Co. acquired 80% of the common stock of Cocker Co. on January 1, 2019, when Cocker had the following stockholders' equity accounts.  To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2022.Popper did not pay any premium when it acquired its original interest in Cocker. On January 1, 2022, Cocker reported a net book value of $1,113,000 before the following transactions were conducted. Popper uses the equity method to account for its investment in Cocker, thereby reflecting the change in book value of Cocker.On January 1, 2022, Cocker issued 10,000 additional shares of common stock for $35 per share. Popper acquired 8,000 of these shares. How would this transaction affect the additional paid-in capital of the parent company?

To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2022.Popper did not pay any premium when it acquired its original interest in Cocker. On January 1, 2022, Cocker reported a net book value of $1,113,000 before the following transactions were conducted. Popper uses the equity method to account for its investment in Cocker, thereby reflecting the change in book value of Cocker.On January 1, 2022, Cocker issued 10,000 additional shares of common stock for $35 per share. Popper acquired 8,000 of these shares. How would this transaction affect the additional paid-in capital of the parent company?

Definitions:

Lead Second

The position or role of supporting leadership by providing feedback, direction, and assistance to the primary leader or team.

Ethical Leadership

The practice of leading by demonstrating ethical behavior, and making decisions that reflect fairness, honesty, and respect for others.

Immediate Supervisor

The person who has direct authority over an employee and is responsible for managing their performance and day-to-day activities.

CEO

The Chief Executive Officer is the top executive in a company or organization, bearing the ultimate responsibility for decision-making.

Q12: A subsidiary of Reynolds Inc., a U.S.

Q13: As of 2017, this is the largest

Q16: This release strategy best matches the needs

Q21: On January 1, 2019, Glenville Co. acquired

Q39: Pell Company acquires 80% of Demers Company

Q60: Stark Company, a 90% owned subsidiary of

Q66: On January 1, 2021, Nichols Company acquired

Q70: Under the initial value method, the parent

Q98: Strickland Company sells inventory to its parent,

Q114: How would you determine the amount of