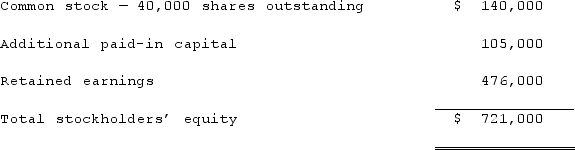

Popper Co. acquired 80% of the common stock of Cocker Co. on January 1, 2019, when Cocker had the following stockholders' equity accounts.  To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2022.Popper did not pay any premium when it acquired its original interest in Cocker. On January 1, 2022, Cocker reported a net book value of $1,113,000 before the following transactions were conducted. Popper uses the equity method to account for its investment in Cocker, thereby reflecting the change in book value of Cocker.On January 1, 2022, Cocker reacquired 8,000 of the outstanding shares of its own common stock for $34 per share. None of these shares belonged to Popper. How would this transaction have affected the additional paid-in capital of the parent company?

To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2022.Popper did not pay any premium when it acquired its original interest in Cocker. On January 1, 2022, Cocker reported a net book value of $1,113,000 before the following transactions were conducted. Popper uses the equity method to account for its investment in Cocker, thereby reflecting the change in book value of Cocker.On January 1, 2022, Cocker reacquired 8,000 of the outstanding shares of its own common stock for $34 per share. None of these shares belonged to Popper. How would this transaction have affected the additional paid-in capital of the parent company?

Definitions:

Persuasive Interview

A structured conversation intended to influence a person’s attitudes, beliefs, or behaviors.

Potential Customer

An individual or entity that could potentially purchase goods or services offered but has not yet done so.

Influence

The capacity to have an effect on the character, development, or behavior of someone or something, or the effect itself.

Unlawful Questions

Refers to inquiries made, especially during job interviews, that are illegal and violate employment laws, often relating to personal attributes such as race, gender, or religion.

Q13: Matthews Co. acquired all of the common

Q15: All of the following were categories of

Q29: Which of the following statements is true

Q38: What is the basic assumption underlying the

Q51: What exchange rate would be used to

Q52: The advantages of the partnership form of

Q55: When a parent uses the partial equity

Q58: Certain balance sheet accounts of a foreign

Q69: P, L, and O are partners with

Q79: Which of the following is a type