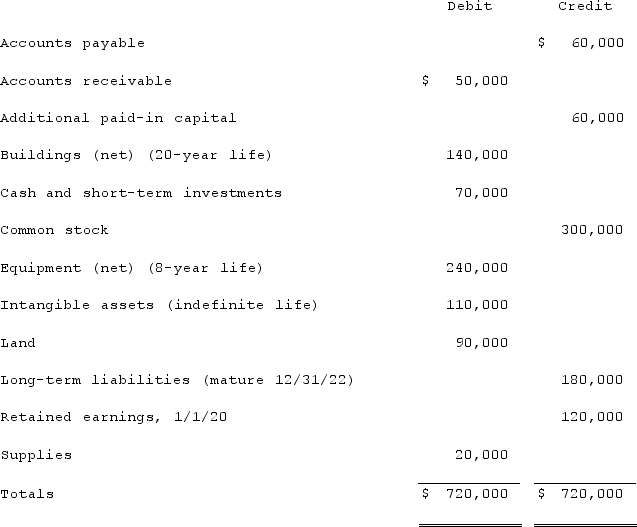

Matthews Co. acquired all of the common stock of Jackson Co. on January 1, 2020. As of that date, Jackson had the following trial balance:

During 2020, Jackson reported net income of $96,000 while paying dividends of $12,000. During 2021, Jackson reported net income of $132,000 while paying dividends of $36,000. Assume that Matthews Co. acquired the common stock of Jackson Co. for $588,000 in cash. As of January 1, 2020, Jackson's land had a fair value of $102,000, its buildings were valued at $188,000, and its equipment was appraised at $216,000. Any excess of consideration transferred over fair value of assets and liabilities acquired is due to an unamortized patent to be amortized over 10 years.Matthews decided to use the equity method for this investment.Required:(A.)Prepare consolidation worksheet entries for December 31, 2020.(B.)Prepare consolidation worksheet entries for December 31, 2021.

During 2020, Jackson reported net income of $96,000 while paying dividends of $12,000. During 2021, Jackson reported net income of $132,000 while paying dividends of $36,000. Assume that Matthews Co. acquired the common stock of Jackson Co. for $588,000 in cash. As of January 1, 2020, Jackson's land had a fair value of $102,000, its buildings were valued at $188,000, and its equipment was appraised at $216,000. Any excess of consideration transferred over fair value of assets and liabilities acquired is due to an unamortized patent to be amortized over 10 years.Matthews decided to use the equity method for this investment.Required:(A.)Prepare consolidation worksheet entries for December 31, 2020.(B.)Prepare consolidation worksheet entries for December 31, 2021.

Definitions:

Vessel Elements

Shorter, wider plant cells than tracheids, found in the xylem, which efficiently transport water and nutrients vertically through the plant.

Perforation Plates

Structures found in the vessel elements of some plants, allowing for the flow of water and nutrients between cells.

Narrower

A comparative term indicating something is less wide or broad, often used in the context of comparisons or descriptions.

Wider

Having a greater width; more broad.

Q4: Webb Company purchased 90% of Jones Company

Q6: Dodd Co. acquired 75% of the common

Q20: Prepare the journal entry and identify the

Q26: What is meant by the term fiscally

Q36: Under modified accrual accounting, when should an

Q38: Pell Company acquires 80% of Demers Company

Q90: Jackson Company acquires 100% of the stock

Q92: Milton Co. owned all of the voting

Q110: Flynn acquires 100 percent of the outstanding

Q111: McGuire Company acquired 90 percent of Hogan