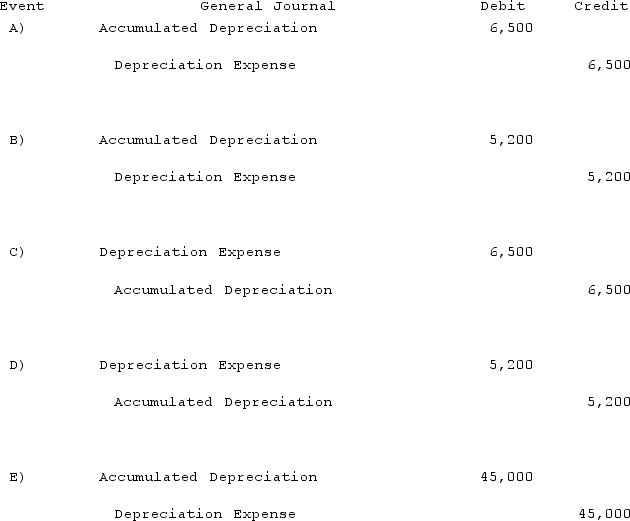

Palmer Corp. owned 80% of the outstanding common stock of Creed Inc. On January 1, 2019, Palmer acquired a building with a ten-year life for $450,000. No salvage value was anticipated and the building was to be depreciated on the straight-line basis. On January 1, 2021, Palmer sold this building to Creed for $412,000. At that time, the building had a remaining life of eight years but still no expected salvage value. For consolidation purposes, what is the Excess Depreciation (ED entry) for this building for 2021?

Definitions:

Heart Surgery

A range of surgical procedures performed on the heart or its vessels to correct congenital defects, treat valvular heart diseases, or manage ischemic heart disease.

Supplemental Oxygen

Additional oxygen provided to patients to ensure they receive adequate oxygen levels in their blood, commonly used in conditions of respiratory distress or chronic lung conditions.

Suctioning

The process of removing obstructions, like fluids, from the body or a body part using a vacuuming action.

Bacterial Endocarditis

An infection of the inner lining of the heart's valves or chambers, typically caused by bacteria.

Q11: When a company applies the initial value

Q16: The financial statements for Campbell, Inc., and

Q18: Wilson owned equipment with an estimated life

Q20: Flynn acquires 100 percent of the outstanding

Q26: Fargus Corporation owned 51% of the voting

Q69: Flynn acquires 100 percent of the outstanding

Q91: Watkins, Inc. acquires all of the outstanding

Q92: On December 1, 2021, Keenan Company, a

Q112: On 1/1/19, Sey Mold Corporation acquired 100%

Q118: Hoyt Corporation agreed to the following terms