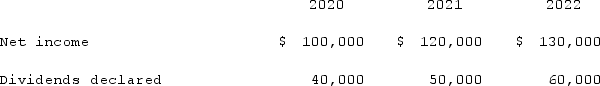

Wilson owned equipment with an estimated life of 10 years when the equipment was acquired for an original cost of $80,000. The equipment had a book value of $50,000 at January 1, 2020. On January 1, 2020, Wilson realized that the useful life of the equipment was longer than originally anticipated, at ten remaining years.On April 1, 2020 Simon Company, a 90% owned subsidiary of Wilson Company, bought the equipment from Wilson for $68,250 and for depreciation purposes used the estimated remaining life as of that date. The following data are available pertaining to Simon's income and dividends declared:  Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, compute Wilson's share of income from Simon for consolidation for 2022.

Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, compute Wilson's share of income from Simon for consolidation for 2022.

Definitions:

Psychotherapy

A therapeutic treatment involving psychological techniques, intended to assist individuals in understanding and resolving their behavioral, emotional, and mental issues.

Middle Eastern Countries

Nations located in the Middle East region, characterized by cultural, religious, and geopolitical diversity, including countries such as Saudi Arabia, Iran, and Israel.

Asian Countries

Refers to nations located on the continent of Asia, including, but not limited to, China, India, Japan, and South Korea.

Bipolar Disorder

A mental health condition characterized by significant mood swings, including manic (or hypomanic) and depressive episodes, affecting one's behavior and functioning.

Q5: Stark Company, a 90% owned subsidiary of

Q16: The following information has been taken from

Q26: The capital account balances for Donald &

Q35: The financial statement amounts for the Atwood

Q36: On January 1, 2021, Veldon Co., a

Q38: On January 1, 2021, Jackie Corp. purchased

Q43: How do intra-entity transfers of inventory affect

Q44: On January 1, 2021, Pride, Inc. acquired

Q84: Kaye Company acquired 100% of Fiore Company

Q108: Duncan Inc. owned all of the outstanding