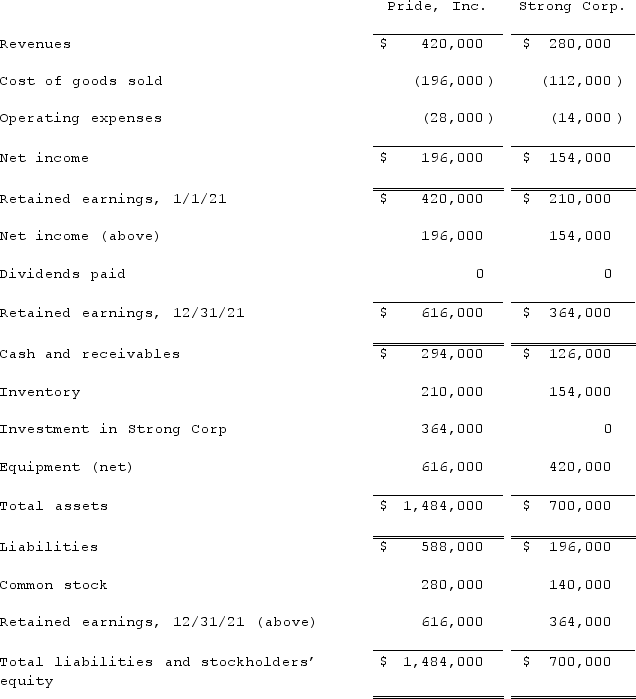

On January 1, 2021, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill, which has not been impaired.As of December 31, 2021, before preparing the consolidated worksheet, the financial statements appeared as follows:  During 2021, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of the inventory purchase price had been remitted to Pride by Strong at year-end. As of December 31, 2021, 60% of these goods remained in the company's possession.What is the total of consolidated cost of goods sold at December 31, 2021?

During 2021, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of the inventory purchase price had been remitted to Pride by Strong at year-end. As of December 31, 2021, 60% of these goods remained in the company's possession.What is the total of consolidated cost of goods sold at December 31, 2021?

Definitions:

Economic Equality

The principle or condition of having equal access to financial resources and opportunities, aiming to reduce disparities in wealth and income among different population groups.

Urban Democracy

The application of democratic governance in urban areas, emphasizing participation of city dwellers in decision-making processes.

Economic Proposal

A formal suggestion aimed at solving an economic issue or improving economic conditions through specific strategies or plans.

Revolutionary War Debts

Financial obligations incurred by the United States during the American Revolutionary War, which led to significant fiscal policy debates in the early republic.

Q10: You are an executive at HBO.Write a

Q19: Which statement is true regarding a foreign

Q40: On December 1, 2021, Keenan Company, a

Q60: Anderson, Inc. acquires all of the voting

Q65: Under the current rate method, inventory at

Q72: Miller, Inc. owns 90 percent of Green,

Q82: With respect to recognizing and measuring the

Q85: The financial statements for Campbell, Inc., and

Q114: How would you determine the amount of

Q116: The following are preliminary financial statements for