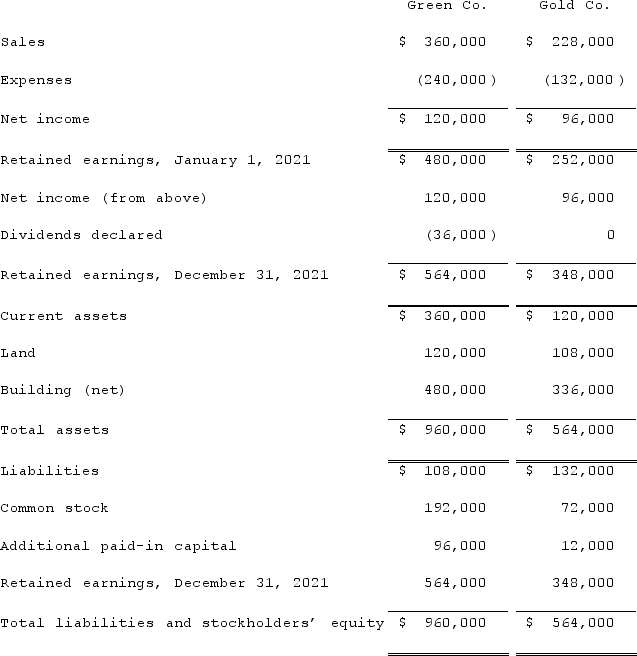

The following are preliminary financial statements for Green Co. and Gold Co. for the year ending December 31, 2021 prior to Green's acquisition of Gold.

On December 31, 2021 (subsequent to the preceding statements), Green exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Gold. Green's stock on that date has a fair value of $60 per share. Green was willing to issue 10,000 shares of stock because Gold's land was appraised at $204,000. Green also paid $14,000 to attorneys and accountants who assisted in creating this combination.Required:Assuming that these two companies retained their separate legal identities, prepare a consolidation worksheet as of December 31, 2021 after the acquisition transaction is completed.

On December 31, 2021 (subsequent to the preceding statements), Green exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Gold. Green's stock on that date has a fair value of $60 per share. Green was willing to issue 10,000 shares of stock because Gold's land was appraised at $204,000. Green also paid $14,000 to attorneys and accountants who assisted in creating this combination.Required:Assuming that these two companies retained their separate legal identities, prepare a consolidation worksheet as of December 31, 2021 after the acquisition transaction is completed.

Definitions:

Hygiene Factor

In Herzberg's motivation theory, factors that can cause dissatisfaction if absent but do not necessarily motivate if present, such as safe working conditions, salary, and company policies.

Hygiene Factors

Aspects of Herzberg’s theory of motivation that focus on the work setting and not the content of the work; these aspects include adequate wages, comfortable and safe working conditions, fair company policies, and job security.

Q4: The City of Ibiza maintains a collection

Q10: When a city received a private donation

Q12: Vickers Inc. acquired all of the common

Q16: On January 4, 2021, Colton Corp. acquired

Q66: Pell Company acquires 80% of Demers Company

Q82: King Corp. owns 85% of James Co.

Q83: Marcia Chan, CEO of Western Medical, told

Q93: Following are selected accounts for Green Corporation

Q110: Flynn acquires 100 percent of the outstanding

Q125: Pepe, Incorporated acquired 60% of Devin Company