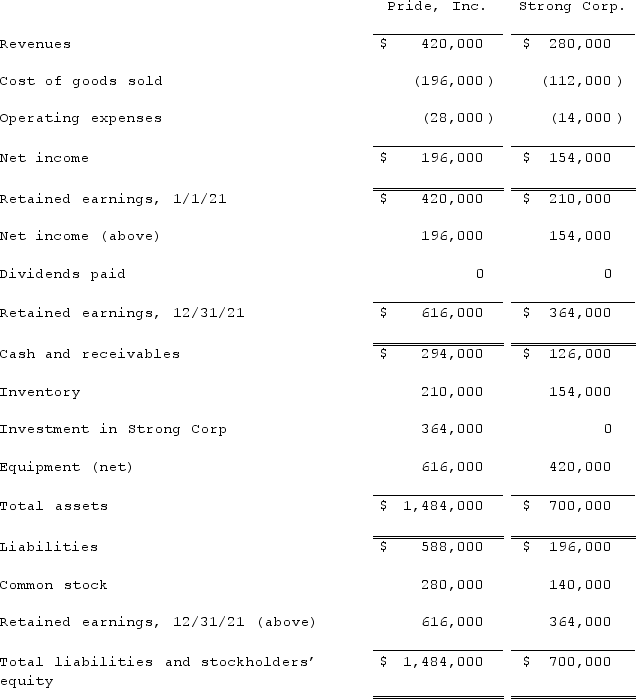

On January 1, 2021, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill, which has not been impaired.As of December 31, 2021, before preparing the consolidated worksheet, the financial statements appeared as follows:  During 2021, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of the inventory purchase price had been remitted to Pride by Strong at year-end. As of December 31, 2021, 60% of these goods remained in the company's possession.What is the consolidated total for equipment (net) at December 31, 2021?

During 2021, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of the inventory purchase price had been remitted to Pride by Strong at year-end. As of December 31, 2021, 60% of these goods remained in the company's possession.What is the consolidated total for equipment (net) at December 31, 2021?

Definitions:

Vertically Integrate

A strategy where a company expands its operations into different steps on the same production path, such as when a manufacturer owns its supplier and/or distributor.

Innovation Group

A team focused on developing and implementing new ideas, processes, or products within an organization.

Organisational Subunit

A smaller, specialized division within an organization designed to carry out specific tasks or functions.

Creative

Pertains to the ability or quality of generating original ideas, approaches, and solutions to problems or challenges.

Q7: On January 1, 2020, Barber Corp. paid

Q27: An investor should always use the equity

Q30: Under the current rate method, which accounts

Q36: Goodman, Pinkman, and White formed a partnership

Q37: A subsidiary of Reynolds Inc., a U.S.

Q48: Virginia Corp. owned all of the voting

Q49: Palmer Corp. owned 80% of the outstanding

Q58: Where do intra-entity transfers of inventory appear

Q59: Jackson Company acquires 100% of the stock

Q86: Esposito is an Italian subsidiary of a