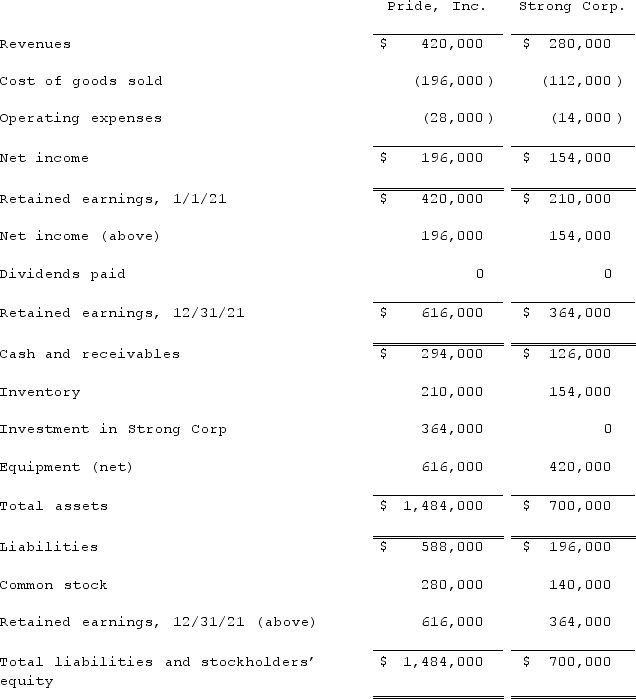

On January 1, 2021, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill, which has not been impaired.As of December 31, 2021, before preparing the consolidated worksheet, the financial statements appeared as follows:  During 2021, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of the inventory purchase price had been remitted to Pride by Strong at year-end. As of December 31, 2021, 60% of these goods remained in the company's possession.What is the consolidated total for inventory at December 31, 2021?

During 2021, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of the inventory purchase price had been remitted to Pride by Strong at year-end. As of December 31, 2021, 60% of these goods remained in the company's possession.What is the consolidated total for inventory at December 31, 2021?

Definitions:

Lessees

Parties that obtain the right to use an asset for a specific period in exchange for payment, under a lease agreement.

Implicit Interest Rate

The rate that equates the present value of lease payments and any unguaranteed residual value to the fair value of the leased asset.

Income Report

An income report, commonly known as an income statement, is a financial document that shows a company's revenue, expenses, and net income over a specific period.

Lease Payments

Regular payments made by a lessee to a lessor for the use of an asset during the lease term.

Q4: Define the philosophy of the #OscarsSoWhite movement.Do

Q17: Coyote Corp. (a U.S. company in Texas)had

Q22: Walsh Company sells inventory to its subsidiary,

Q31: Which of the following type of organization

Q45: Pot Co. holds 90% of the common

Q54: Ginvold Co. began operating a subsidiary in

Q73: Pell Company acquires 80% of Demers Company

Q74: Certain balance sheet accounts of a foreign

Q80: Strickland Company sells inventory to its parent,

Q104: Clark Co., a U.S. corporation, sold inventory