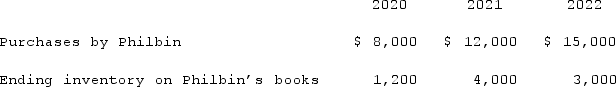

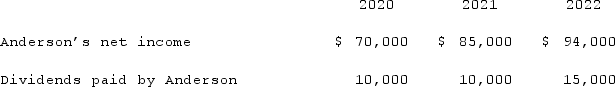

Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin's intra-entity purchases from Anderson. Anderson was acquired on January 1, 2020.  Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.

Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends. Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, compute the net income attributable to the noncontrolling interest of Anderson for 2020.

Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, compute the net income attributable to the noncontrolling interest of Anderson for 2020.

Definitions:

Payments

Transactions by which goods, services, or obligations are paid for through the transfer of money or its equivalents.

Compounded Monthly

A method where interest earned is added to the principal monthly, so that each subsequent interest calculation is made on a larger amount.

Retirement Savings Plan

A financial arrangement designed to help individuals save for their retirement, offering various tax advantages.

Contributions

Payments or deposits made into a particular fund or account for the purposes of investment or savings growth.

Q1: Kennedy Company acquired all of the outstanding

Q39: On January 1, 2020, Mehan, Incorporated purchased

Q41: Thomas Inc. had the following stockholders' equity

Q45: Pell Company acquires 80% of Demers Company

Q66: Pell Company acquires 80% of Demers Company

Q75: Anderson Company, a 90% owned subsidiary of

Q92: Panton, Inc. acquired 18,000 shares of Glotfelty

Q95: To account for a forward contract cash

Q99: On January 1, 2021, Anderson Company purchased

Q123: Several years ago, Polar Inc. acquired an