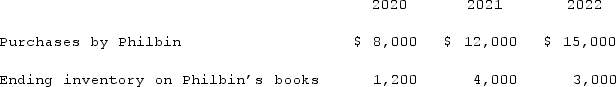

Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin's intra-entity purchases from Anderson. Anderson was acquired on January 1, 2020.  Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.

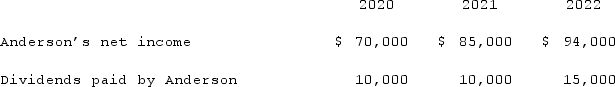

Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends. Compute the equity in earnings of Anderson reported on Philbin's books for 2020.

Compute the equity in earnings of Anderson reported on Philbin's books for 2020.

Definitions:

Corn Crop Yield

The total production of corn measured in units (such as bushels per acre) harvested from a given area.

Complements

Products or services that complement each other, such that a rise in the demand for one results in a rise in the demand for its counterpart.

Price of Yogurt

The amount of money required to purchase a unit or quantity of yogurt in the market.

Equilibrium Price

The cost point where the amount of a product or service that buyers want matches the amount that sellers offer, leading to equilibrium in the market.

Q8: How can an import purchase result in

Q26: When an investor sells shares of its

Q39: On January 1, 2020, Mehan, Incorporated purchased

Q55: Certain balance sheet accounts of a foreign

Q56: Following are selected accounts for Green Corporation

Q58: Where do intra-entity transfers of inventory appear

Q67: A company has a discount on a

Q72: A net liability balance sheet exposure exists

Q84: Jet Corp. acquired all of the outstanding

Q98: Clark Co., a U.S. corporation, sold inventory